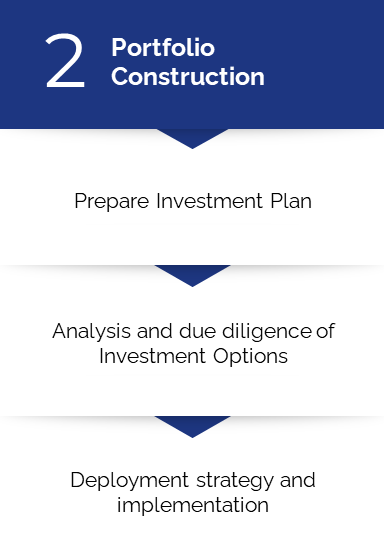

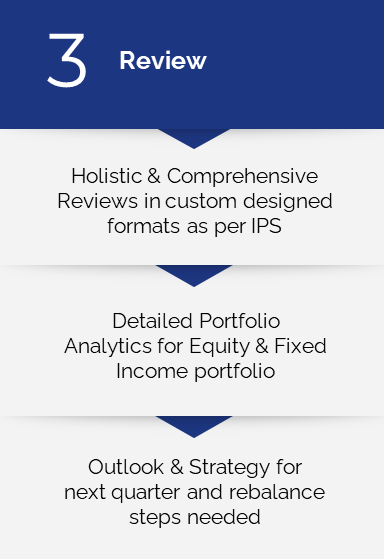

Consortium Securities provides a complete platform to help manage and track all your investments in one place. We are a SEBI registered stock broker, NSDL Depository Participant, AMFI Registered Mutual Fund Distributor and have tie-ups with various companies for distribution of Fixed Deposits, NCDs and Alternate Products. Our platform offers customized solutions as well as execution services.

Our primary responsibility is risk management and we believe returns are an outcome. In order to do this, we use time tested principles of asset allocation and diversification. By maintaining an open architecture, it doesn’t matter to us where the investment idea originates or who executes it as long as it’s a good product and a good fit. Our responsibility is to evaluate the product thoroughly and present our recommendations to the clients (as appropriate and allowed by regulations), so an informed decision can be made.