Why maintaining Asset Allocation is essential for your portfolio?

“Asset Allocation” is one of the most important and most frequently used terms in personal finance. It is fairly straight forward to understand but requires a lot of discipline to implement over a period of time.

A portfolio consists of different asset classes like Equity, Debt, Real Estate, Gold, etc. Each of these asset classes has a different risk-reward profile and investment horizon. Correlation in returns across these asset classes also varies. When constructing a portfolio while clients often focus on past returns and expected returns, a wealth manager focuses on managing risk and often works backwards in terms of constructing the lowest risk portfolio to meet client return objectives. Having a wider investment universe enables the wealth manager to construct a lower risk portfolio which may end up being better suited to meet the client’s requirements.

An important message here is that timing is extremely difficult and often leads to an anchoring bias in investments. When we talk about Asset Allocation, the emphasis is on identifying the right asset allocation given the client’s requirements. At Consortium, all our portfolio reviews start with reviewing the asset allocation and then get into product specific adjustments required.

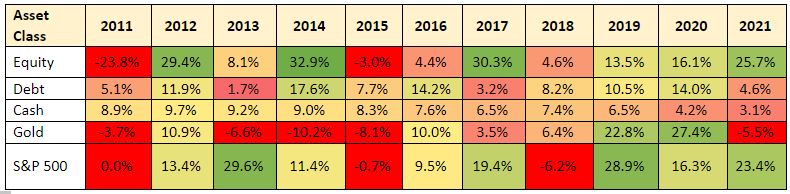

Past returns of some of the major asset classes:

Equity (Nifty TRI), Debt (CCIL Bond Index), Cash (SBI Liquid Fund), Gold (SBI Gold ETF)

Source– NGEN Database

The above table shows the varying degree of returns across asset classes and shows the importance of having a diversified portfolio across these asset classes. This not only helps reduce the overall risk on a portfolio, but by having a disciplined asset allocation, it gives investors an opportunity to take advantage of the market volatility. In order to do this, wealth managers have a core strategic allocation as well as tactical allocation. At Consortium, this forms an integral part of our asset allocation framework and we will cover that in another post in detail.

Leave a Reply