Should you invest in Credit Risk Debt Funds?

Investing in debt funds are usually considered very safe and less risky compared to Equity. In debt funds, mainly money is deployed into high rated corporate bonds, government securities and treasury bills issued by RBI that keep on generating fixed interest over the period in the portfolio. There is no market volatility in debt funds like Equity. However, different types of risk factors are found in debt investments. Credit/Default Risk is one of them. It is very important to figure it out before putting your hard-earned money in debt instruments.

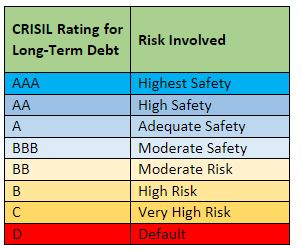

Credit risk arises when companies fail to make an interest payment on the issued bond to bondholders. In another word, it refers to the chances of making defaults in the interest payment by the companies due to stress in cash flow. To measure this, credit rating agencies are formed by SEBI who provide credit ratings to all bond issuing companies based on their financial status and several other parameters through which we can take at least a fair idea of credit risk involved in them. However, it is always not necessary that ratings provided by them are always absolutely right. That is why all fund houses do their research to make investment decisions.

As per the mandate, Credit risk funds invest more than 65% of total assets in below highest-rated bonds like AA or A and below. Taking more risk increases the chances of generating good returns. However, there will be always a chance of default if the rating is lower and that can make your investment journey disheartening in case any credit events take place, unfortunately. In the past few years, lots of credit events like DHFL, IL&FS, YES bank, Essel Group, Reliance ADAG etc. happened.

After the pandemic, the financial statement of all small and middle-sized companies has got impacted a lot. That is why most of the fund managers are playing safe now and have increased exposure to high rated instruments like AAA and SOV to mitigate the risk. The main objective of investing in a debt fund is the safety of capital and getting decent returns. There is no point to take a risky bet on the invested corpus. If you want to take risks and higher returns, it is better to put it in Equity funds.

In the current scenario, the credit risk category is not a good option to add to your portfolio just by the lure of higher returns, it may damage your portfolio. If you need any assistance to build a healthy portfolio, please write to us at wealth@consortiumsecurities.com. We will be glad to help you.

Leave a Reply