Fixed Deposits vs. Debt Mutual Funds

In ancient times, people used to use carts to go from one place to another and took several days to reach their destination. But now, we have Luxury Car, Airplane, Metro, fastest bullet train and so many advanced vehicles for travelling. This is all the results of changes where there must have been chaos at the beginning of use. Now, we are comfortable in all these.

The same also applies to our investment journey where most of us are still stuck with traditional financial instruments like Fixed Deposits, physical Real Estate and physical Gold. These have become outdated now. Fixed Deposit only provides fixed (and to some extent guaranteed returns). Apart from this, it has nothing special. Returns are usually low, there is no liquidity available and they are tax inefficient. Moreover, TDS and tax are paid every year on the accrued interest due to which overall growth on the invested capital is not as high as it should be. For better compounding, the outflows from the investment should be as little as possible. You will be surprised to know that you are paying a very high effective tax rate on interest earned in FD as compared to Debt Mutual Fund. Even more than your tax slab. We know that it is unbelievable and difficult for you to accept it but unfortunately, it’s true. Let’s analyze a simple comparison to understand it better.

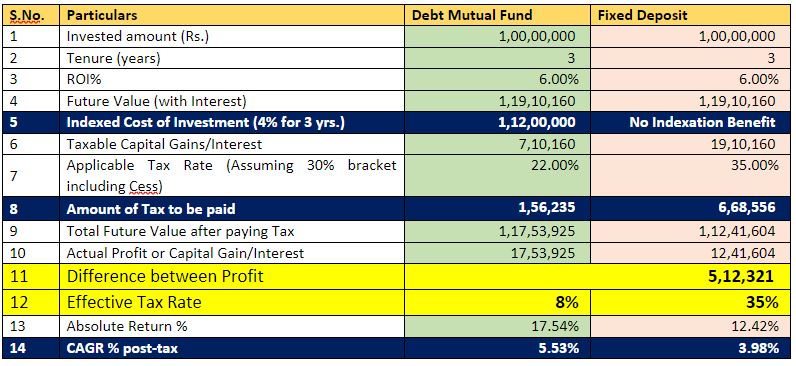

For example, you invest Rs 1 Crore in Debt Mutual Fund and Fixed Deposit at 6% (assumed rate for calculation) for 3 years.

As you can see from the above data, the effective tax rate is 35% in FD which means you are paying 35% of your total earned interest. It is very high. Whereas it is very less in the case of Debt funds i.e., only 8%. You cannot imagine how much you are losing just by investing in FDs. The total difference between interest earned on FD and capital gain on Debt Mutual Fund is around Rs 5 Lakhs if 6% is taken in both scenarios.

Debt funds are very tax-efficient and very flexible to invest in. Returns delivered by debt is also better than FD if invested for more than 3 years. Liquidity is also one of the best parts of it that allows you to invest and redeem any amount, anytime and anywhere without any penalty or exit load.

So, if you are planning to put your hard-earned money into FD for the long term (more than 3 years), think a little bit and analyze all aspects before investing.

Please write to us at wealth@consortiumsecurities.com if you find any difficult to plan your investment or need any clarification related to personal finance. We will connect with you.

Leave a Reply